Commercial Insurance In Toccoa Ga for Dummies

Some monetary consultants use estate preparation services to their customers. They could be learnt estate planning, or they might intend to collaborate with your estate attorney to address questions concerning life insurance policy, depends on and what should be made with your investments after you die. It's essential for economic advisors to stay up to date with the market, financial problems and advisory ideal methods.

To market financial investment products, experts need to pass the pertinent Financial Sector Regulatory Authority-administered examinations such as the SIE or Series 6 exams to obtain their accreditation. Advisors who desire to sell annuities or other insurance items need to have a state insurance permit in the state in which they prepare to sell them.

Everything about Insurance In Toccoa Ga

You work with an advisor who bills you 0. Due to the fact that of the typical charge framework, lots of experts will not work with customers that have under $1 million in properties to be managed.

Financiers with smaller sized profiles might seek an economic advisor who charges a hourly charge rather of a percent of AUM. Per hour fees for advisors typically run between $200 and $400 an hour. The more complicated your financial situation is, the more time your advisor will have to devote to managing your properties, making it a lot more pricey.

Advisors are proficient specialists that can aid you create a strategy for monetary success and execute it. You may likewise take into consideration connecting to an advisor if your individual economic conditions have actually lately come to be a lot more difficult. This might indicate getting a home, marrying, having youngsters or obtaining a big inheritance.

Everything about Commercial Insurance In Toccoa Ga

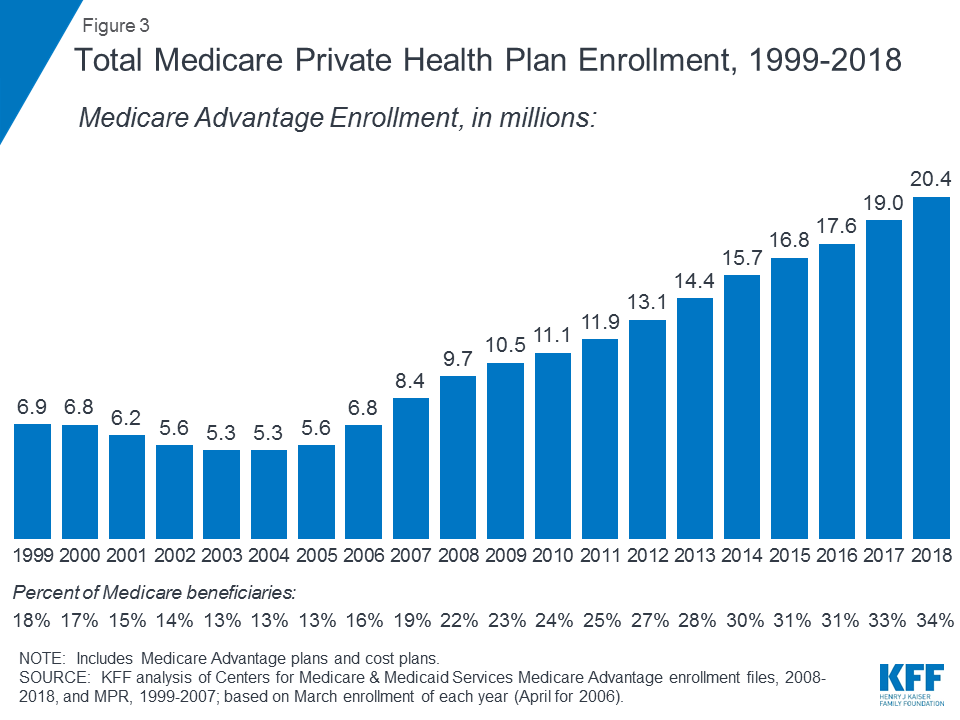

Before you fulfill with the advisor for a preliminary consultation, consider what solutions are most vital to you. Older adults may require aid with retirement planning, while younger adults (Medicare/ Medicaid in Toccoa, GA) may be trying to find the very best way to invest an inheritance or beginning an organization. You'll desire to look for out an advisor who has experience with the services you desire.

How much time have you been suggesting? What business were you in prior to you entered monetary recommending? Who makes up your typical customer base? Can you give me with names of several of your customers so I can discuss your services with them? Will I be dealing with you straight or with an associate expert? You may also desire to consider some example economic strategies from the advisor.

If all the examples you're offered coincide or comparable, it may be a sign that this consultant does not properly tailor their recommendations for each customer. There are three primary types of financial suggesting experts: Certified Economic Planner specialists, Chartered Financial Analysts and Personal Financial Specialists - https://www.artstation.com/jstinsurance14/profile. The Qualified Financial Organizer professional (CFP specialist) accreditation indicates that an advisor has met a professional and ethical standard established by the CFP Board

Rumored Buzz on Health Insurance In Toccoa Ga

When choosing an economic consultant, take into consideration somebody with a professional credential like a CFP or CFA - https://www.mixcloud.com/jstinsurance1/. You could additionally take into consideration an advisor who has experience in the services that are essential to you

These consultants are usually filled with conflicts of passion they're much more salesmen than consultants. That's why it's critical that you have an expert who works only in your benefit. If you're looking for a consultant that can truly supply actual worth to you, it is necessary to investigate a variety of prospective choices, not merely select the given name that advertises to you.

Currently, numerous consultants have to act in your "benefit," however what that involves can be nearly unenforceable, except in one of the most outright situations. You'll need to locate an actual fiduciary. "The initial examination for a good monetary advisor is if they are benefiting you, as your supporter," says Ed Slott, certified public accountant and owner of "That's what a fiduciary is, yet everybody says that, so you'll require other indicators than the consultant's say-so or perhaps their qualifications." Slott suggests that customers want to see whether consultants buy their ongoing education and learning around tax preparation for retirement financial savings such as 401(k) and IRA accounts.

"They need to confirm it to you by showing they have taken serious ongoing training in retired life tax obligation and estate preparation," he claims. "You must not invest with any advisor that does not invest in their education.